KPN is introducing new mobile subscriptions from 01 July, completely revamping its existing offer. Under the current offers, customers can put together their own bundle of data, voice and SMS and add a handset under a lease construction. These offers were first introduced almost a year ago, meaning the new offers come just as many annual contracts may be expiring.

The timing is interesting for several other reasons.

First because the operator is abandoning handset leasing just before the lease contract expires with a number of customers (although customers can maintain existing lease contracts if they like). Online forums are full of complaints from customers about the leasing scheme, with one of the most common complaints the cost to buy the phone at the end of the contract. For many consumers, the price is often higher than expected. Customers who at first thought they would pay around EUR 100 are instead receiving bills for EUR 200. From a marketing perspective, this is not a good move. Rivals are also exploiting the frustration at KPN customers with slogans such as "With us, the handset belongs to you" (MTV Mobile). All of this suggests that leasing has not really caught on with a significant number of customers.

KPN has said it will maintain leasing at its brands Hi and Telfort. However, at least one of these brands is likely to end up abandoning the concept, as KPN is not making the change itself for no reason. Telfort, which focuses on mid-range smartphones, would likely profit the most from stopping the lease model.

It's also interesting to see how quickly KPN has responded to new offers introduced recently by Vodafone and T-Mobile. KPN's new plans are a mix of Vodafone’s Red subscriptions and the speed caps introduced by T-Mobile.

One needs to look close to spot the differences between KPN's plans and Vodafone's offers. The prices are very close and the bundles nearly identical. Launching a new product that looks practically the same as your rival's doesn't suggest a great deal of competitive inspiration. KPN's subscriptions otherwise have a speed cap after using up the monthly data bundle, and the internet speeds are a bit higher, at 25Mbps for the cheapest plan and 50Mbps (where available) for the top plan.

Any difference with Vodafone Red is nearly non-existent in terms of the amount of data and SMS included. KPN customers can also choose to pay extra each month for a more high-end handset.

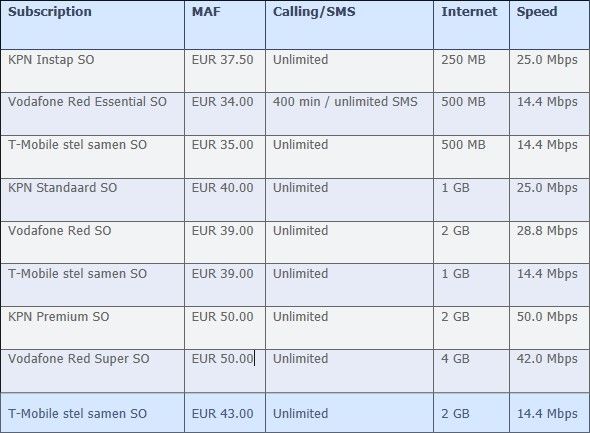

Sim-only plans:

If KPN had not cut in half the amount of data on the Sim-only plans, the bundles would be nearly identical. The same is true for the standard plans with handset. It's remarkable how close the price points are. These do not take into account any network discounts.

The prices for subscriptions with handsets are also very similar when compared with Vodafone. At Vodafone customers can choose to buy the phone in one go instead of paying extra each month, reducing their costs over a two-year contract.

KPN's plan have gotten cheaper at the higher end. The current Sim-only offer with unlimited calls and 250 MB per month costs EUR 50 (EUR 40 in a promotion), while unlimited calls with 1GB data is EUR 55 (EUR 44 in promotion). Even compared to the promotional prices, KPN's new offers are cheaper. At the moment KPN is clearly the most expensive provider. With the new offers it has come down on the high end, but at the same made its low-end offers so unattractive that any smart consumer would look elsewhere.

KPN is punishing customers who want a Sim-only plan by cutting the amount of data included in half. This step alone makes KPN the most unattractive provider for Sim-only - a strange and some would say customer-unfriendly choice.

The new Sim-only tariffs called Budget Mobiel are expensive. The plan with 100 minutes or SMS costs EUR 12.50 per month, and 150 minutes or SMS is charged EUR 15 per month. The name 'Budget' is as such a misnomer. The next step up, the Basis Mobile Sim-only plans, offer 100 minutes and SMS and 50MB for EUR 20 per month or 200 minutes and SMS plus 100 MB for EUR 30 per month. KPN doesn't appear interested in targeting Sim-only customers. These plans also have a speed cap on the data bundle.

KPN previously used as its selling point the fact that customers could assemble their own bundles, a unique offering on the market. Customers could also switch to a higher or lower bundle each month at no charge. It's change in approach is highlighted further by the recent ad at T-Mobile, where Ali B makes a call to the T-Mobile management to say that if he wants access to 2 GB of data each month, he should not have to also pay for a big voice bundle. And the management agrees with him.

KPN customers who also have a triple-play plan with the operator will get double the minutes and MB in their mobile plans. Family members will also get EUR 10 off their mobile plans each month. This is a nice offering that could have been more successful if KPN's low-end plans were a bit cheaper or included more.

It's strange how operators launch new products saying they're responding to customer demands and then the new product clearly does not incorporate those demands. At first glance, KPN's new plans are not an improvement. The only positive points are dropping the lease construction and the speed caps, as well as the drop in price on the high-end plans. But for customers who want 100 minutes and a lot of data or those who call a lot and don't use internet much, these offers are less attractive.

KPN may want to send these customers to its other brands, but it could just be sending them to the competition. Notably this is the first time KPN is following the competition. In the past it was always the trend-setter in developing new subscription offers (both good and bad ones).